Transforming Inventory into Profit

Did you know that your Purchasing Department can add profit to your bottom line faster than your Sales Department?

For example, a typical industrial sales representative might take 2-4 weeks to generate $100,000 in sales, resulting in approximately $3,500 in net profit before taxes.

In comparison, the Purchasing Department can achieve the same result in just an afternoon.

Here’s how: by purchasing $10,000 worth of fast-moving stock from The DeadStock Broker at a cost of $6,500, you instantly save $3,500, which goes directly to your bottom line.

Inventory Metrics

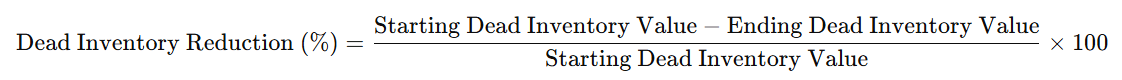

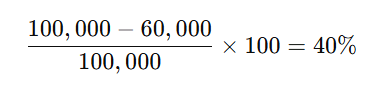

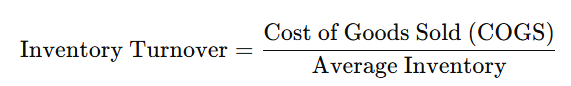

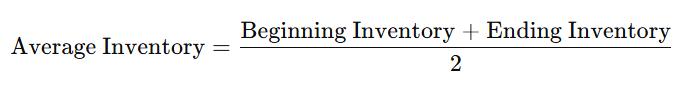

Measuring the impact of reducing dead inventory and optimizing purchasing requires tracking specific key performance indicators (KPIs) and comparing them before and after implementing your strategies. Here’s a breakdown of how you can measure these impacts effectively: